All Categories

Featured

Table of Contents

Regardless of being recognized, all capitalists still require to do their due diligence throughout the process of investing. Certified investors can access our selection of vetted financial investment possibilities.

With over $1.1 billion in securities marketed, the administration group at 1031 Crowdfunding has experience with a variety of investment frameworks. To access our complete offerings, register for a financier account.

Accredited's workplace society has actually usually been We believe in leaning in to sustain improving the lives of our colleagues in the very same way we ask each other to lean in to passionately sustain enhancing the lives of our clients and community. We provide by supplying methods for our group to rest and re-energize.

Client-Focused Private Investments For Accredited Investors Near Me – Cincinnati

We additionally provide to Our beautifully assigned building consists of a fitness room, Relax & Leisure rooms, and innovation created to support flexible offices. Our finest ideas originate from collaborating with each various other, whether in the office or working from another location. Our proactive financial investments in modern technology have actually allowed us to develop an allowing staff to contribute wherever they are.

If you have a rate of interest and feel you would be an excellent fit, we would certainly love to link. Please inquire at.

Top Tax-advantaged Investments For Accredited Investors Near Me (Cincinnati OH)

Accredited financiers (in some cases called professional investors) have access to investments that aren't available to the general public. These financial investments could be hedge funds, difficult money lendings, exchangeable financial investments, or any kind of various other security that isn't signed up with the economic authorities. In this post, we're going to focus specifically on realty investment alternatives for recognized investors.

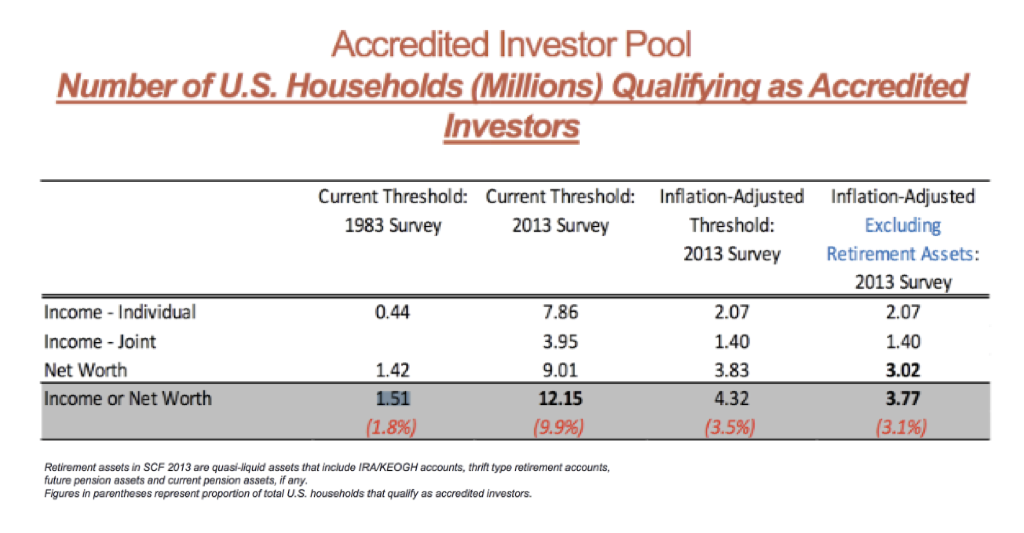

This is whatever you require to understand about property investing for recognized capitalists (returns for accredited investors). While any individual can invest in well-regulated safeties like stocks, bonds, treasury notes, shared funds, and so on, the SEC is worried about ordinary financiers entering investments past their ways or understanding. So, as opposed to enabling anyone to purchase anything, the SEC produced an accredited investor requirement.

It's crucial to keep in mind that SEC regulations for recognized financiers are made to secure financiers. Without oversight from economic regulators, the SEC merely can't review the threat and incentive of these investments, so they can't offer details to enlighten the average investor.

The idea is that capitalists who make sufficient income or have sufficient wide range are able to absorb the risk far better than financiers with lower income or much less riches. As a recognized capitalist, you are anticipated to complete your very own due diligence before adding any kind of possession to your financial investment portfolio. As long as you fulfill one of the following four needs, you qualify as a recognized investor: You have earned $200,000 or even more in gross revenue as a private, every year, for the previous 2 years.

Innovative Alternative Investments For Accredited Investors

You and your partner have had a mixed gross revenue of $300,000 or more, each year, for the previous two years (high yield investments for accredited investors). And you expect this degree of revenue to continue.

Or all equity proprietors in the service qualify as recognized capitalists. Being an accredited investor opens doors to financial investment possibilities that you can't access or else.

Dynamic Accredited Property Investment Near Me

Ending up being a recognized financier is just a matter of proving that you satisfy the SEC's requirements. To validate your revenue, you can supply documents like: Earnings tax returns for the previous two years, Pay stubs for the previous 2 years, or W2s for the previous 2 years. To validate your net well worth, you can offer your account statements for all your assets and responsibilities, consisting of: Cost savings and inspecting accounts, Investment accounts, Outstanding fundings, And realty holdings.

You can have your attorney or CPA draft a confirmation letter, validating that they have actually reviewed your financials and that you fulfill the needs for a recognized financier. It may be more affordable to use a service particularly made to verify accredited capitalist conditions, such as EarlyIQ or .

Dynamic 506c Investment Near Me – Cincinnati

For instance, if you authorize up with the property investment company, Gatsby Investment, your recognized financier application will certainly be refined through VerifyInvestor.com at no expense to you. The terms angel financiers, sophisticated capitalists, and recognized financiers are frequently made use of mutually, yet there are refined differences. Angel financiers provide venture capital for start-ups and local business in exchange for ownership equity in business.

Normally, anybody that is certified is thought to be an advanced capitalist. The income/net worth needs stay the exact same for foreign financiers.

Here are the finest financial investment chances for certified capitalists in genuine estate.

Some crowdfunded realty financial investments do not need accreditation, however the jobs with the greatest possible incentives are typically reserved for recognized financiers. The difference between projects that approve non-accredited financiers and those that only accept certified investors generally comes down to the minimal investment quantity. The SEC currently limits non-accredited financiers, who make less than $107,000 annually) to $2,200 (or 5% of your yearly earnings or total assets, whichever is much less, if that quantity is greater than $2,200) of investment capital annually.

Table of Contents

Latest Posts

Investing In Tax Liens

Delinquent Tax Houses

Tax Foreclosed Property

More

Latest Posts

Investing In Tax Liens

Delinquent Tax Houses

Tax Foreclosed Property